Most Investors Don’t Need More Capital.

They Need More Grit.

Let me be straight with you for a minute…

In this market, everyone’s looking for some magic lever—more capital, more partners, more lenders, more this, more that.

But after 17 years, hundreds of flips, and millions in commercial assets purchased and sold…

I can tell you with full confidence:

It was never the capital that saved my deals.

It was the grit.

I didn’t start with a team.

I didn’t start with money.

I didn’t start with experience.

I started with a beat-up little 2-bedroom that smelled like wet carpet and regret — and a willingness to outwork the situation.

And honestly?

That part hasn’t changed.

When You’re Resourceful, You Don’t Panic — You Solve.

Just last month, I got a quote for $3,200 to paint a vacant apartment.

Materials: about $500.

So what did we do?

We painted it ourselves in 3 days.

Next quote:

$6,500 to sealcoat a small parking lot.

Materials: roughly $750.

We knocked it out in 2 days.

Clean lines. Perfect coverage. Done.

Commercial roof seal?

Quoted $5,500.

I did it for $1,000 in material — and learned another skill for the tool belt.

And over the years?

I’ve:

Cut down my own trees

Demolition

Built walkways

Painted every railing you can imagine

Repaired units at 10 p.m. because it needed to get done

And cut 3 acres on a $500 zero-turn instead of paying $350/week

Not because I had to…

But because I’m not too good to protect my own assets.

There’s a company I can call for literally every one of those things.

Doesn’t mean I use them.

I’ve still got paint on half my clothes.

I’m still walking my 14-unit, tightening door handles and changing bulbs with a coffee in my hand.

It’s not glamorous.

But every time I do it, I’m reminded:

This is the difference-maker.

This is why certain investors survive when the market tightens and others fold.

Here’s the Truth Most Investors Avoid:

Resourcefulness beats resources.

Every. Single. Time.

Anybody can pay their way out of a problem when the market is hot.

You find out who the real operators are when things cool off.

During tight seasons, sweat equity is the difference between a deal that bleeds and a deal that works.

It’s the difference between:

Cash-flowing and cash-burning

Keeping an asset and being forced to sell

Staying in the game and getting swallowed by it

I didn’t go from one property to 500+ deals…

I didn’t go from small flips to $35M+ in commercial deals since 2020…

By pretending I was “above” a paintbrush and a .

3 Rules I Live By (Especially in 2025’s Market)

✅ Rule #1: Know What You Can Learn Fast

You don’t need a certification.

You need a willingness to try.

YouTube → Materials → Roll up sleeves → Done.

You’ll save money, improve the asset, and sharpen your instincts.

✅ Rule #2: Take Pride in the Property, Not Just the Pro Forma

Some of my biggest wins came from simply being on-site.

A small fix turned into a referral.

A fresh paint job brought in a new lease.

A simple conversation with a tenant revealed a looming problem before it became expensive.

You can’t see any of that from behind QuickBooks.

✅ Rule #3: Resourcefulness > Resources

The ones who win now aren’t the ones with the biggest bank accounts…

They’re the ones who refuse to:

Wait for the perfect quote

Wait for the perfect partner

Wait for the perfect conditions

They move.

They solve.

They adapt.

You can’t outsource pride.

You can’t delegate instincts.

You can’t replace showing up.

And sometimes?

The highest ROI is literally swinging the brush.

My business coach used to tell me:

“Steve, you still have to do the dishes.”

Seventeen years later, I’m still doing the dishes.

How about you?

Are you in the field?

Are you walking your buildings?

Are you protecting your assets with your own two hands when it matters?

Or are you hoping someone else will care as much as you do?

Let’s talk.

📍 Book a call: FreedomStackOS.com

📧 Email me: [email protected]

Be resourceful.

It always pays.

— Steve

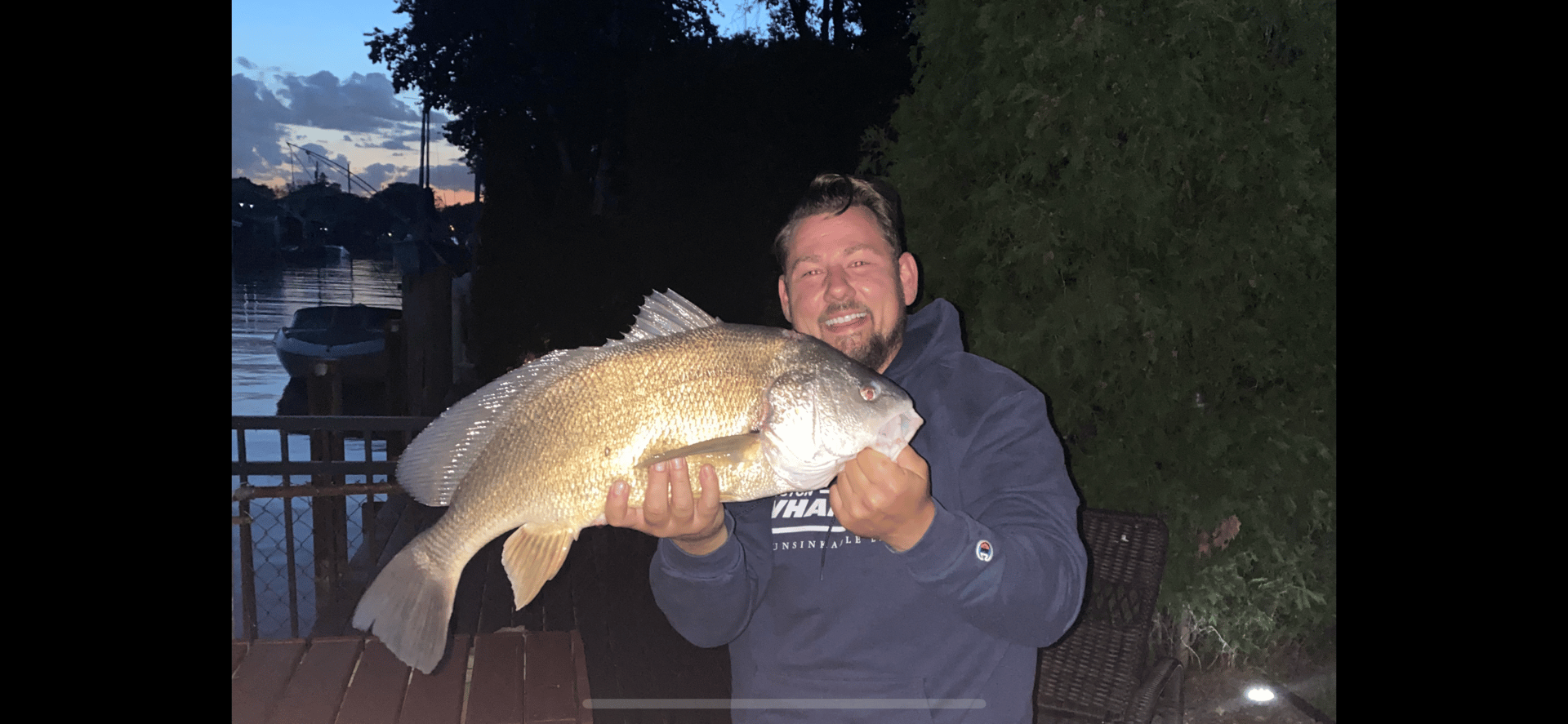

Big ass fish I caught in my backyard!